“Go to the ant, thou sluggard; consider her ways, and be wise: Which having no guide, overseer, or ruler, provideth her meat in the summer, and gathereth her food in the harvest.” Proverbs 6:6-8

It is only wise to prepare now for the years when you can no longer work and when most are looking forward to retirement. My advice to young families is to save as though Social Security will not be there for them—for it very well may not. Fifty years ago there were sixteen workers for every one on Social Security. Now there are only three paying in for every one taking out.

When you think of investing for retirement, the first thing to think about is your home. Hopefully, by that time it will be paid off and worth more than you paid for it. In most cases, if you sell your home at a profit you will not have to pay capital gain taxes on your increase. You can downsize and place the difference in your retirement account.

Over and above your home, you –like the ant, need to save a portion during the years you are gainfully employed for the time you cannot work. The 10-10-10-70 rule is a good plan to follow. You give God the first 10% of your income. You save 10% for the unexpected and big purchases, you invest 10% for your retirement years –and then you live on 70% of your income. As a rule of thumb, you will need 60-85% [adjusted for inflation] of your current income in order to maintain your present lifestyle.

Before you can save and invest you must first eliminate all credit and consumer debt. You really have no money to invest if you owe money at high interest. I do not claim to be an expert or a counselor in financial matters, but I do want to pass on what I have learned and found to work for me. First, I do not recommend using a Whole Life Insurance policy as a vehicle of investment. The only reason for Life Insurance is to protect your family—to do that you buy a simple Term policy. There are better vehicles to invest for retirement.

1. 401[k] Plans

Many employers offer plans whereby they will withhold a set portion of your income and place it in an account set up in your name. Not only does it allow the money to accrue tax-free until you use it but may allow you to invest this money in a limited way in stocks and mutual funds. Many times the company will match some of the money placed into this fund. Many employers encourage you to invest most of it in company stocks but this is not wise. You need to spread your investments over a number of stocks—never put all of your eggs in one basket.

2. IRA Accounts

These are Tax-deferred ‘umbrellas’ under which you can invest your savings until retirement. Taxes are paid when this money is withdrawn. You are free to invest this money many ways to get the best return.

3. Roth IRA Accounts

This is a relatively new plan but is very good for young families for it allows them to pay the tax up front when they are still in a low tax bracket. The money then grows tax-free until it is used in retirement. You then can withdraw it tax free.

A word of caution: there are very stiff penalties if IRA money is touched before 59 1/2 years of age, unless there is a proven dire emergency.

The question now is where do you invest these accounts for they can be placed in many places—all giving a different rate of interest. For the last 30 years the stock market by far has been the best place for it has returned an average of 11% during the good and the bad years. Since most young families are not knowledgeable in investing in stocks and bonds—and since there are risks in investing in only one or two company stocks—I advise keeping your retirement money in Mutual Funds.

Mutual Funds spread the risk by buying into many companies. They also give you the advantage of professional management at a very low commission. There are many to chose from but many authorities suggest that you begin with a ‘no load’ Index Fund such as one of the Vanguard Funds, which have a proven record. Here again there are choices, you can chose Growth funds which have more risk but gives a better rate of return –or Bonds which are safer but are not as profitable.

The secret is faithfulness. “It is given unto Stewards that they be found faithful.” Invest a constant amount each month and depend upon ‘Dollar Cost Averaging’ to build your nest egg. By investing a constant amount you still come out ahead both when the market is up or when it is down, for the lower the cost of shares the more shares you get. By saving $2.74 per day you can save $1000 in a year. By investing $10,000 at 9% it will double to $20,000 in just 8 years –if you just leave it alone.

Finally, a wise steward will write and place in a safe place a ‘Will’. A Will expresses Your wishes as to how the assets of your estate should be distributed upon your death. Without it, the government takes a large share and the family is torn about how to distribute the rest.

“But if any provide not for his own, and especially for those of his own house, he hath denied the faith, and is worse than an infidel” [I Timothy 5:8].

You might also like these articles...

Does It Have to Take a Heart Attack?

Whereas ye know not what shall be on the morrow. For what is your life? It is even a vapour, that appeareth for a little time, and then vanisheth away. James 4:14 A heart attack can do wonders for your family and church relationships – if you will let it. Thirteen years ago ago while…

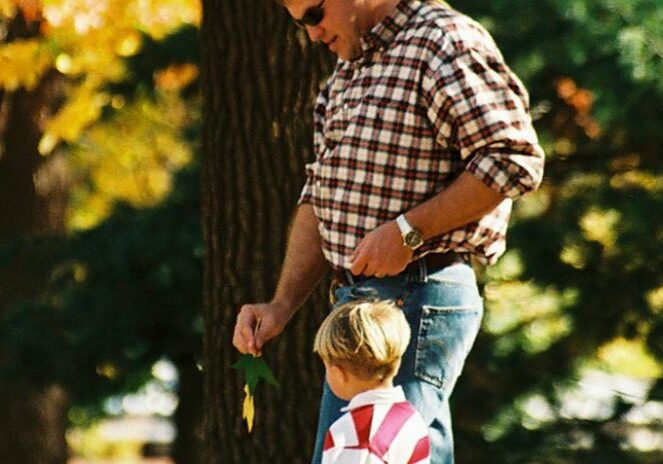

Talking With Your Teenager

“And these words… shall be in thine heart: and thou shalt teach them diligently unto thy children, and shalt talk of them when thou sittest… when thou walkest… when thou liest down, and when thou risest up” (Deuteronomy 6:6,7). Question: “How can I communicate with my teenager? He either does not want to talk to…

Daddy, Give Me My Blessing!

“Do you have only one blessing? my father Bless me, even me also, O my father.” Genesis 27:31-34 Can you hear the cry? “Bless me – me also, O my father!” After reading this passage in the Bible the other morning I went and found my copy of The Gift of The Blessing, by Gary…